Get Closer to your Home Loan Customers

Qualify, Assess and Convert more homebuyers with Homely's AI Powered Platform

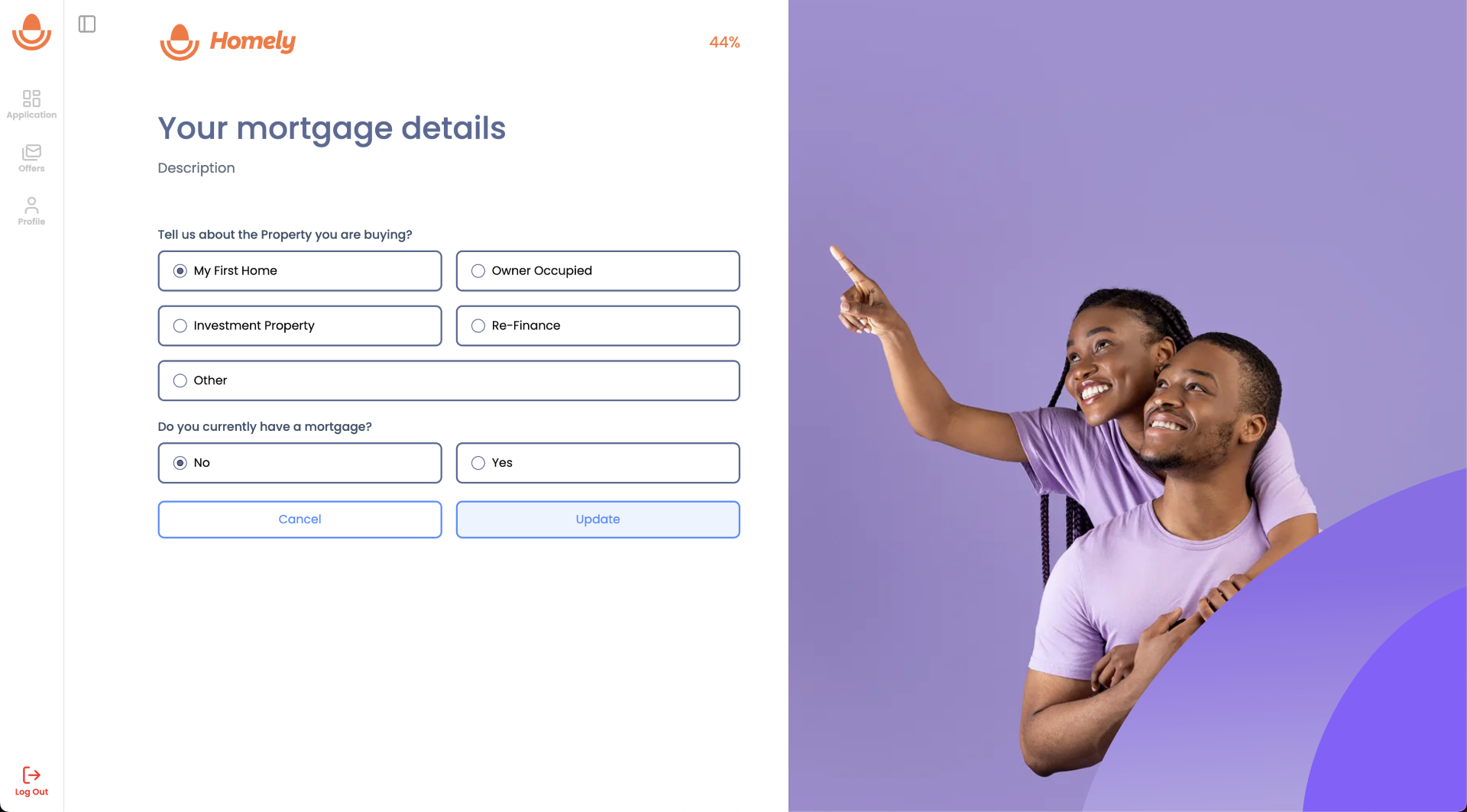

Smarter Qualification

Prioritised high-value, pre-qualified applicants, complete with identity verification, security information, financial documents, and a detailed credit profile enabling faster, more confident decisions.

Everything In One Place

No more back-and-forth with home buyers. Loan officers receive all the necessary information upfront including pre-calculated risk metrics,reducing delays and friction.

Lower Acquisition and Operational Costs

Homely’s direct-to-bank model reduces reliance on intermediaries and manual processing, leading to significant cost savings at scale.

UPTO

70%

Less effort on application processing

Homely automates data collection, credit profiling, and document retrieval, freeing up your team to focus on high quality approvals instead of data collection and preparation.

UPTO

5x

Faster Application Assessments

Homely accelerates application processing by up to five times, helping lenders to approve more loans in hours, not weeks.

Fully Qualified

Homely evaluates applications against lender-specific credit policies and criteria, ensuring you receive only ready-to-approve home buyers.

Better bank matching

Home buyers are matched with the right lenders using Homely's proprietary Application Score, which considers a range of factors such as lender preferences, financial profiles, and creditworthiness.

Automate Everything

Our proprietary AI replaces slow, error-prone, low-value human tasks, automating everything from data collection to the preparation of risk metrics for scorecards.

API and System Integration

Homely will seamlessly integrate with your CRM and Loan Origination Systems, minimizing redundancies, eliminating data silos, and optimizing workflows.

Better, Faster, Smarter

Home loans made simple with AI and Smart Tech

Open Banking Ready

Standardised data structures and real-time API integrations provide a seamless pathway to enable Open Banking connectivity.

Tech Alignment

Homely is designed to evolve with your systems and core banking platforms, ensuring long-term scalability and flexibility.

Security and Compliance

Homely meets all local and international compliance requirements as required by the financial services industry.

FAQs

Everything you need to know about becoming a lender with homely

Homely is a genuinely digital-only platform, designed to eliminate the need for human brokers by leveraging AI and advanced technology. It operates as a direct-to-bank, fully digital solution, the first of its kind in New Zealand.

No. Homely does not provide financial advice. While we comply with the Financial Markets Conduct Act 2013 and follow the guidelines of the Financial Markets Authority (FMA), we do not employ FAP-licensed financial advisers. For customers seeking financial advice, we recommend speaking with a qualified financial adviser.

Our research shows that many borrowers prefer self-service tools for lender research, but a lack of effective options often drives them to mortgage brokers. Homely fills this gap by offering a fully digital, AI-driven platform for self-directed customers.

Homely charges a Success Fee for funded loans, similar to mortgage brokers. However, our fees are typically lower, reflecting the efficiency achieved through automation rather than human labour. Success fees vary depending on loan volume and the level of technical integration each lender chooses to have with Homely.

None. Homely functions as a standalone SaaS platform that mirrors a human broker’s workflow but with far greater automation. Lenders can start using Homely without any integration. However, to maximise efficiency, various integration options are available, which can reduce loan origination effort by up to 70%.

Lender participation is welcome at every stage of development. We are actively collaborating with selected lenders to customise both the customer journey and backend workflows to match each lender’s preferences. A Beta site with core functionalities will be available by the end of the year for lenders to explore and test the platform.

Smart Tools for Savvy homebuyers

Sign up to unlock more of our smart tools and take control of your home buying journey.